ローレンス・サマーズ「今後の経済で金融政策がマクロ経済安定化の第一手段となるかは疑わしい」

-

motidukinoyoru

motidukinoyoru

- 3986

- 39

- 6

- 8

Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Coming into Jackson Hole, economists are grappling with a major issue: Can central banking as we know it be the primary tool of macroeconomic stabilization in the industrial world over the next decade? In my forthcoming paper w/ @annastansbury, we argue that this is in doubt. 1/

2019-08-22 19:51:43 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

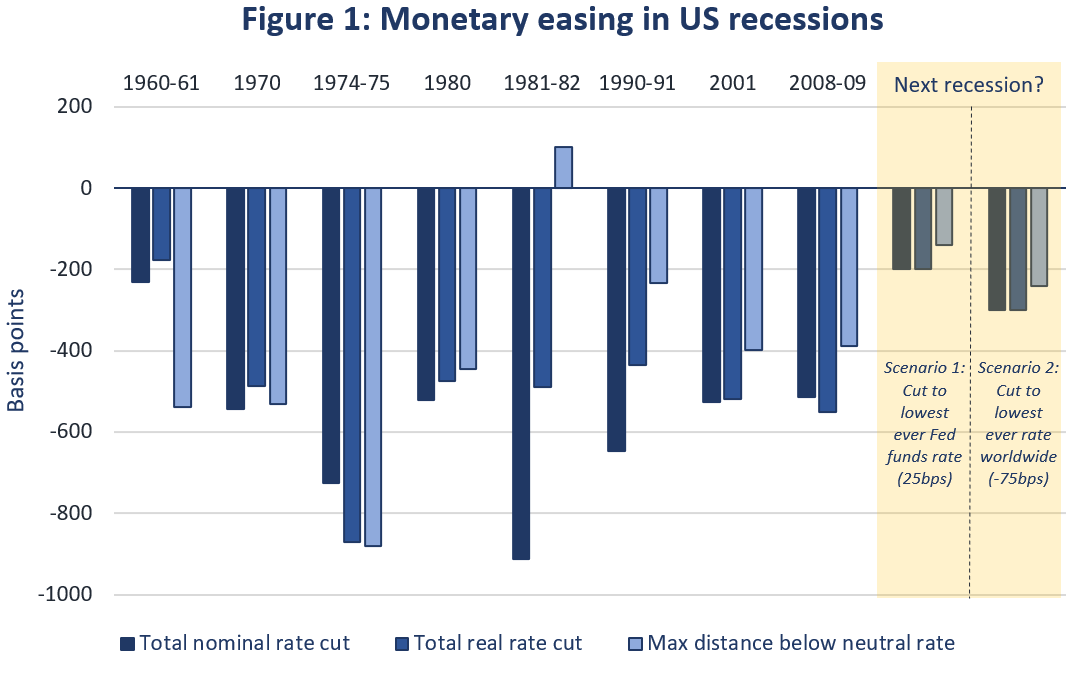

There is little room for interest rate cuts. In every US recession since the 1970s, the fed funds rate was cut >500bps. In most, the real rate fell >400bps below the neutral rate. Now, the max. feasible cut is 200-300bps, bringing the real rate only 150-250bps below neutral. 2/ pic.twitter.com/6QfiaVykU7

2019-08-22 19:51:45 拡大

拡大

Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

This limited space for interest rate cuts is true of the US, which has the highest interest rates in the industrialized world. It is even more true of Europe and Japan. 3/

2019-08-22 19:51:46 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

QE and forward guidance have been tried on a substantial scale. We are living in a post QE and forward guidance world. It is hard to believe that changing adverbs here and there or altering the timing of press conferences or the mode of presenting projections is consequential. 4/

2019-08-22 19:51:46 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

We usually agree w/ Janet Yellen, but believed at the time of her 2016 Jackson Hole speech -and believe even more in today’s world of 150bp 10yr rates- that her optimism about the existing monetary policy toolkit is misplaced. 5/ federalreserve.gov/newsevents/spe… washingtonpost.com/news/wonk/wp/2…

2019-08-22 19:51:46 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Black hole monetary economics - interest rates stuck at zero with no real prospect of escape - is now the confident market expectation in Europe & Japan, with essentially zero or negative yields over a generation. The United States is only one recession away from joining them. 6/

2019-08-22 19:51:46 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Everywhere in the industrial world, the risks of a sharp upturn in unemployment appear greater than the risks of a sharp upturn in inflation (even though market expectations of inflation are clearly below 2 percent targets). 7/

2019-08-22 19:51:47 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

The one thing that was taught as axiomatic to economics students around the world was that monetary authorities could over the long term create as much inflation as they wanted through monetary policy. This proposition is now very much in doubt. 8/

2019-08-22 19:51:47 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Many believe that events proved Alvin Hansen wrong about secular stagnation. On the contrary, the fact that it took WW2 to lift the world out of depression proves his point. Absent the military buildup, a liquidity trap deflation scenario would likely have persisted. 9/

2019-08-22 19:51:47 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Call it the black hole problem, secular stagnation, or Japanification, this set of issues should be what central banks are worrying about. 10/

2019-08-22 19:51:48 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

We have come to agree w/ the point long stressed by Post Keynesian economists & recently emphasized by Palley that the role of specific frictions in economic fluctuations should be de-emphasized relative to a more fundamental lack of aggregate demand. 11/ elgaronline.com/view/journals/…

2019-08-22 19:51:48 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

In our forthcoming paper, we argue that it minimizes our predicament to see it – as is current consensus – simply in terms of a falling neutral rate, low inflation, and the effective lower bound on nominal rates. Secular stagnation is a more profound issue. 12/

2019-08-22 19:51:48 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Limited nominal GDP growth in the face of very low interest rates has been interpreted as evidence simply that the neutral rate has fallen substantially. There may well be more to it than that. 13/

2019-08-22 19:51:48 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

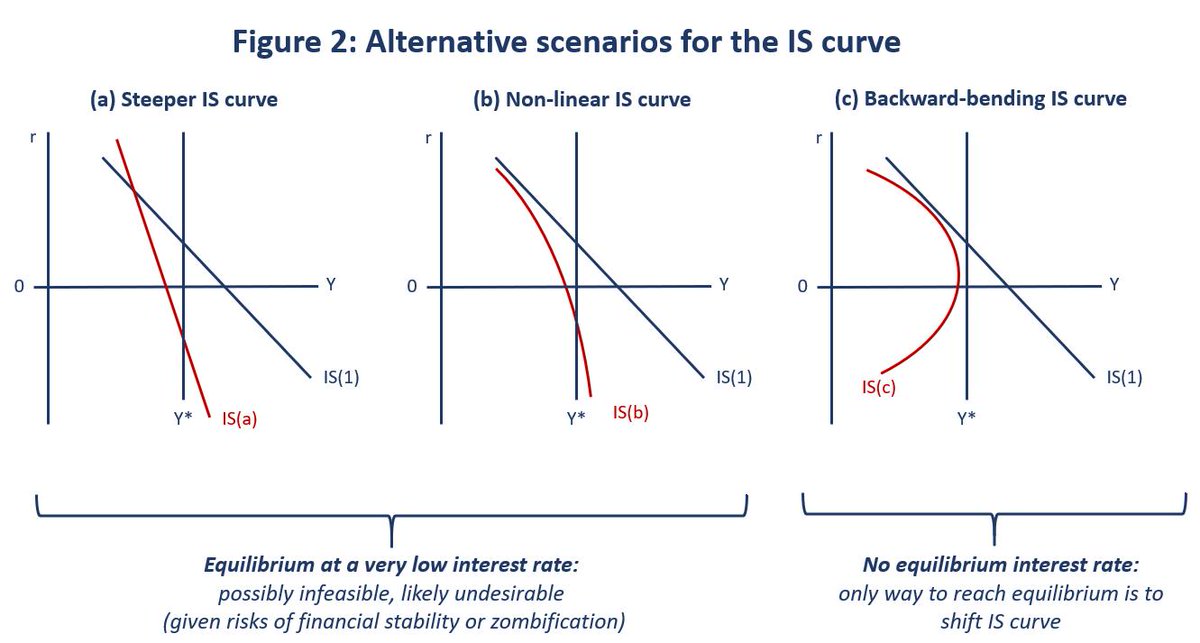

We believe it is at least equally plausible that the impact of interest rates on aggregate demand has declined sharply, and that the marginal impact falls off as rates fall. 14/

2019-08-22 19:51:49 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

It is even plausible that in some cases interest rate cuts may reduce aggregate demand: because of target saving behavior, reversal rate effects on fin. intermediaries, option effects on irreversible investment, and the arithmetic effect of lower rates on gov’t deficits. 15/

2019-08-22 19:51:49 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

This can be illustrated using a textbook macroeconomic diagram with a very steep, non-linear or even backward-bending IS curve. 16/ pic.twitter.com/MKLzEjTPHs

2019-08-22 19:51:52 拡大

拡大

Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

If the central problem for macroeconomic stabilization is a falling neutral real interest rate – what might be called “old new Keynesian” economics – monetary policy can achieve full employment if it can get the interest rate low enough. 17/

2019-08-22 19:51:52 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

In contrast under the secular stagnation view we have outlined – what might be called “new old Keynesian” economics – interest rate cuts, even if feasible, may be at best only weakly effective at stimulating aggregate demand and at worst counterproductive. 18/

2019-08-22 19:51:52 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

There is the further point that reducing interest rates may degrade future economic performance for any of the following reasons. 19/

2019-08-22 19:51:53 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

First, financial instability. The financial crisis had roots in bubbles & excessive leverage caused by efforts to maintain demand after the 2001 recession. Japan’s late 1980s bubble had roots in a low interest rate tight fiscal environment after the 1987 stock market crash. 20/

2019-08-22 19:51:53 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Second, risks of zombification of firms. Firms that do not face debt service payments are like students who do not have to take tests. They can drift along complacently & ultimately unsuccessfully. And low rates may contribute to increased monopoly power and reduced dynamism. 21/

2019-08-22 19:51:53 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Third, risks of bank failures. Low rates crowd bank profits and franchise value, making them more vulnerable to adverse shocks at any given level of regulatory capital. 22/

2019-08-22 19:51:53 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Fourth, risks of further reducing monetary policy effectiveness. To the extent to which rate cuts now “borrow” demand from the future as firms and consumers bring forward investment and durable purchases, low rates now may imply less effective monetary policy in the future. 23/

2019-08-22 19:51:54 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

The right issue for macroeconomists to be focused on is assuring adequate aggregate demand. We believe it is dangerous for central bankers to suggest that they have this challenge under control - or that with their current toolkit they will be able to get it under control. 24/

2019-08-22 19:51:54 Lawrence H. Summers

@LHSummers

Lawrence H. Summers

@LHSummers

Obviously fiscal policy needs to be a major focus, especially given what low or negative interest rates mean for the sustainability of deficits. 25/

2019-08-22 19:51:54